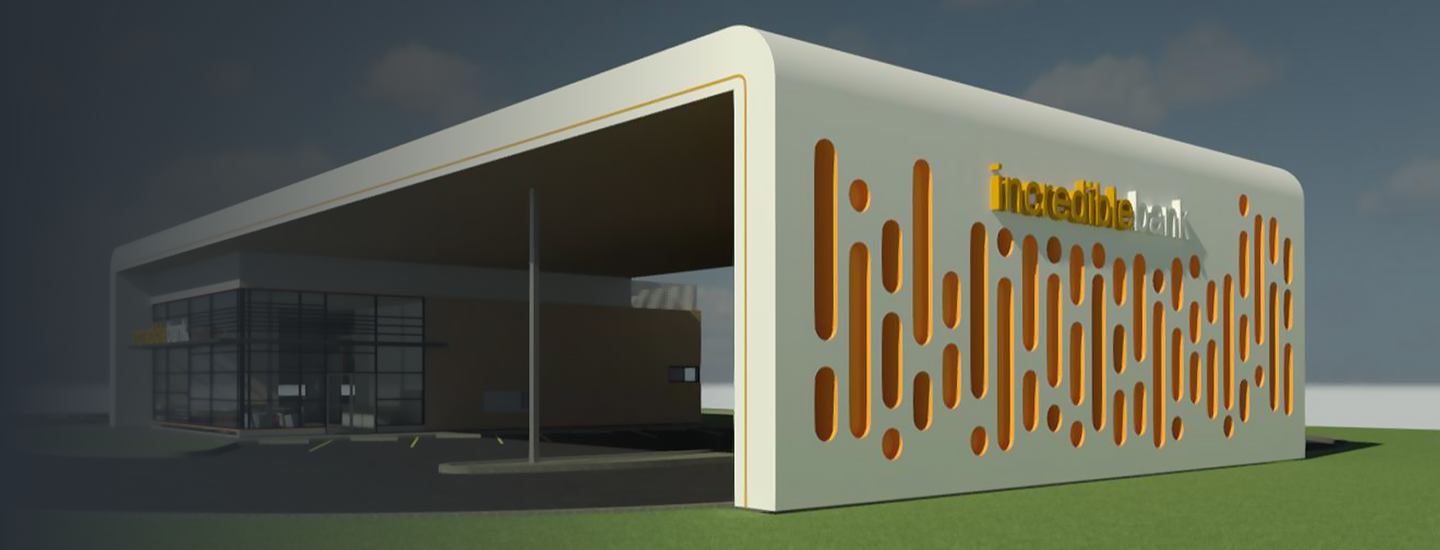

Settle for Nothing Less than Incredible

Our mission is to grow our customers' entire financial relationship, and we believe that starts by providing an

Incredible Customer Experience - or ICE, as we call it - with every interaction. Whether you are a young family looking for your first home or an experienced business owner expanding operations, we have the products, the technology, and most importantly, the people, to get you to your incredible. Come find out how rewarding banking can be.