USDA Loans

What Is A USDA Loan?

USDA loans are loans backed by the United States Department of Agriculture for businesses working in rural areas. We partner with the United States Department of Agriculture to offer USDA Government Guaranteed Loans.

How USDA Loans Work

If your business is located in a rural community, you can take advantage of loans from the U.S. Department of Agriculture (USDA) and the U.S. Farm Service Agency (FSA). To qualify as a rural business, you must be in a community or area with a population under 50,000 – this tool from the USDA can help you determine if you qualify by your address.

Funds can be used for the following:

- Developing, converting, modernizing, enlarging, or repairing your business.

- Land purchase and development.

- Purchasing equipment, leasehold improvements, machinery, supplies, or inventory.

- Refinance existing debt, if new jobs will be created and other conditions are met.

- Business and industrial acquisitions when the loan will keep the business from closing and/or save or create jobs.

Already have a loan with us and need to make a payment?

More Banking Options For Your Business

Business Checking

You need a business checking account that gets the job done - so you can get your job done. We have multiple account options to meet your unique needs.

Business Line Of Credit

A business line of credit differs from a term loan, which provides a lump sum of cash upfront and then is repaid over a fixed period of time. With a line of credit, you draw and use funds, make payments, and continue to reuse the line as long as it's open.

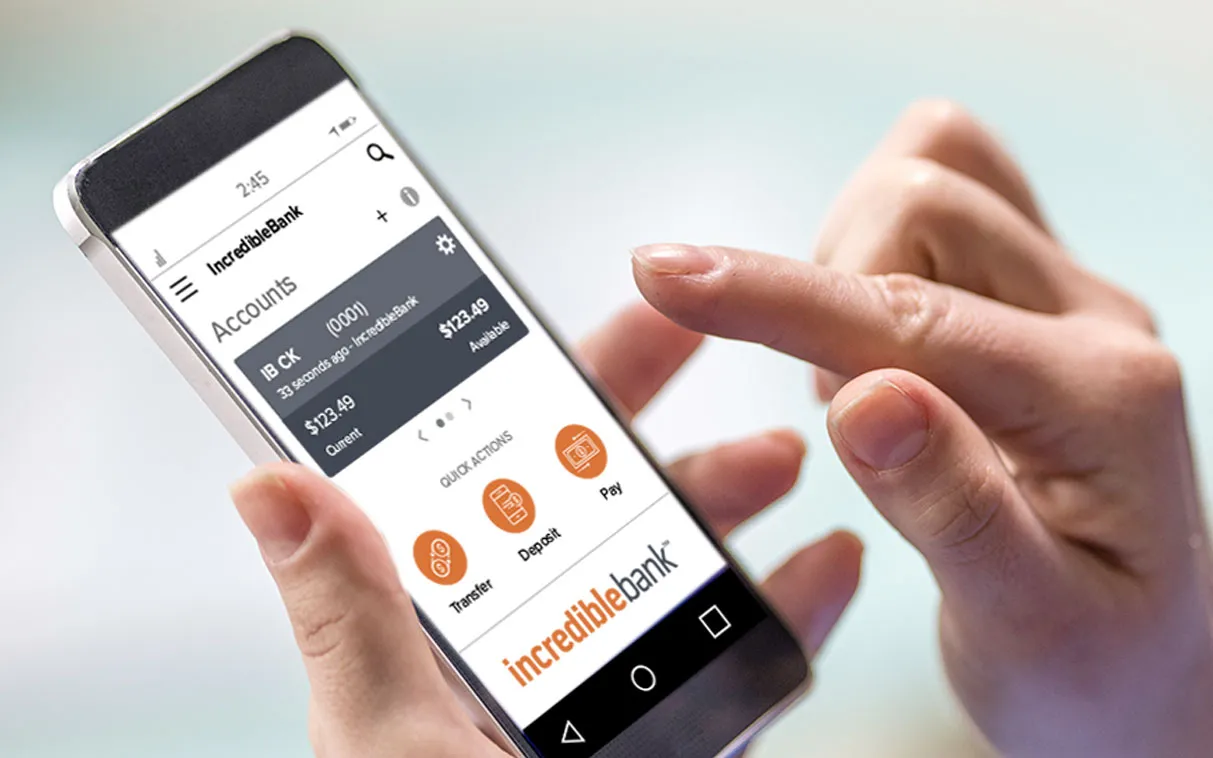

Mobile App

Stay in control of your finances from the palm of your hand. Pay bills anytime, deposit checks, check balances, view transactions, and transfer funds with our IncredibleBank mobile app.