Business Line of Credit

How A Business Line Of Credit Works

A business line of credit differs from a term loan, which provides a lump sum of cash upfront and then is repaid over a fixed period of time. Depending upon your needs at the time, you can draw from your line of credit, maintain its balance, and revolving lines can be reused as often as you’d like, providing you make payments at a specified time and don’t exceed your credit limit. IncredibleBank typically allows you to repay your full balance early which saves on interest costs.

Need to fill out a Personal Financial Statement?

Want to make a payment on an existing loan?

How To Qualify For A Business Line Of Credit

1

First your business will need to demonstrate strong revenue and several years of history.

2

Next, IncredibleBank will require a couple of documents in order to give us a better financial picture of your business.

What documents will I need?

Two years of personal tax returns

Two years of business tax returns

Personal Financial Statement

3

Next, you'll either start an application online, or contact a banker. It's up to you.

More Banking Options For Your Business

Business Checking

You need a business checking account that gets the job done - so you can get your job done. With multiple account options, we have an account to fit your unique needs.

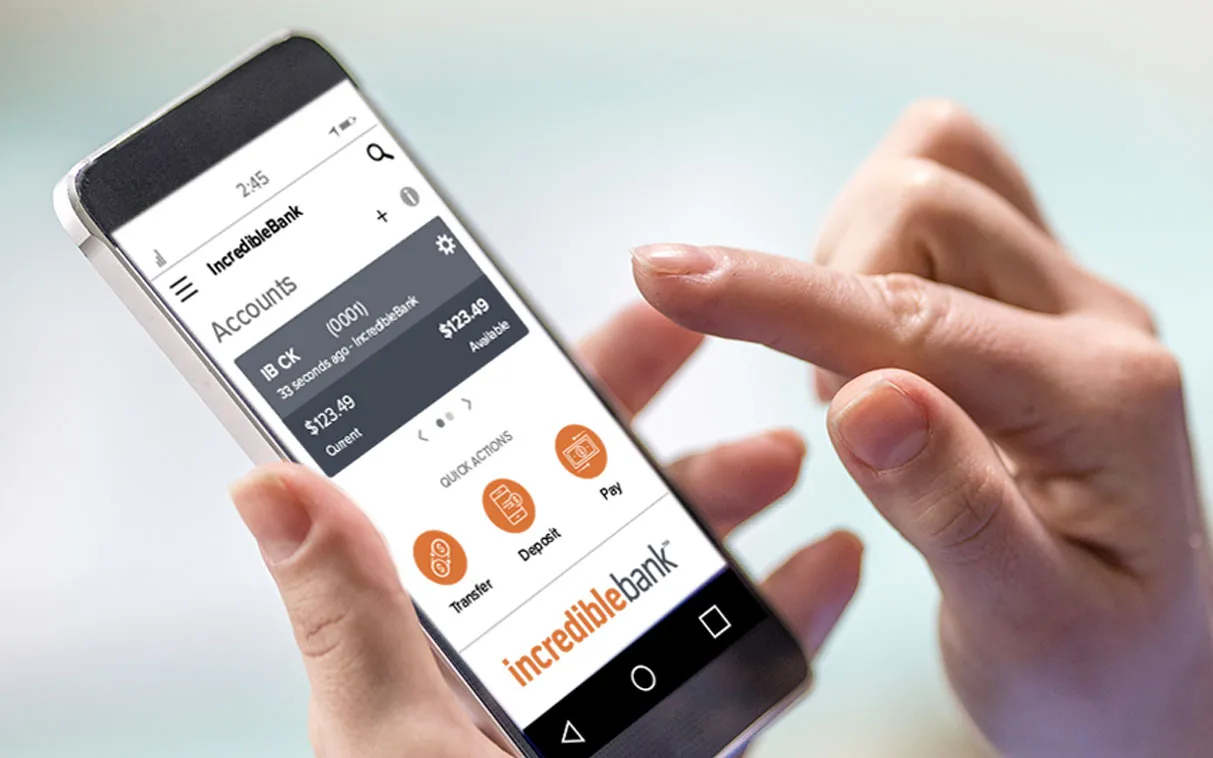

Mobile App

Stay in control of your finances from the palm of your hand. Pay bills anytime, deposit checks, check balances, view transactions, and transfer funds with our IncredibleBank mobile app.

Business Services

We know managing business cash flow can be challenging, which is exactly why we offer several business solutions to help you find your incredible.