Business Term

What Is A Business Term Loan?

When your business needs to purchase equipment, renovate office space, or make a similar type of investment, a term loan might be your best option, which gives you the cash to grow your business. Here’s what you need to know about term loans before you submit an application.

How Does a Business Term Loan Work?

If you have a car loan, student loan, or a mortgage, then you likely know how a term loan works. You borrow a lump of cash upfront and repay the loan over a set period of time.

Loan requirements, rates, and funding vary between banks. At IncredibleBank, we offer competitive rates on term loans and can have repayment terms of up to 10 years.

IncredibleBank also offers Small Business Administration loans, which are guaranteed by the government. This type of term loan provides up to $5 million and carries repayment terms of up to 25 years, making them a good option for long-term financing needs.

Need to fill out a Personal Financial Statement?

Want to make a payment on an existing loan?

More Banking Options For Your Business

Business Line Of Credit

A business line of credit differs from a term loan, which provides a lump sum of cash upfront and then is repaid over a fixed period of time. With a line of credit, you draw and use funds, make payments, and continue to reuse the line as long as it's open.

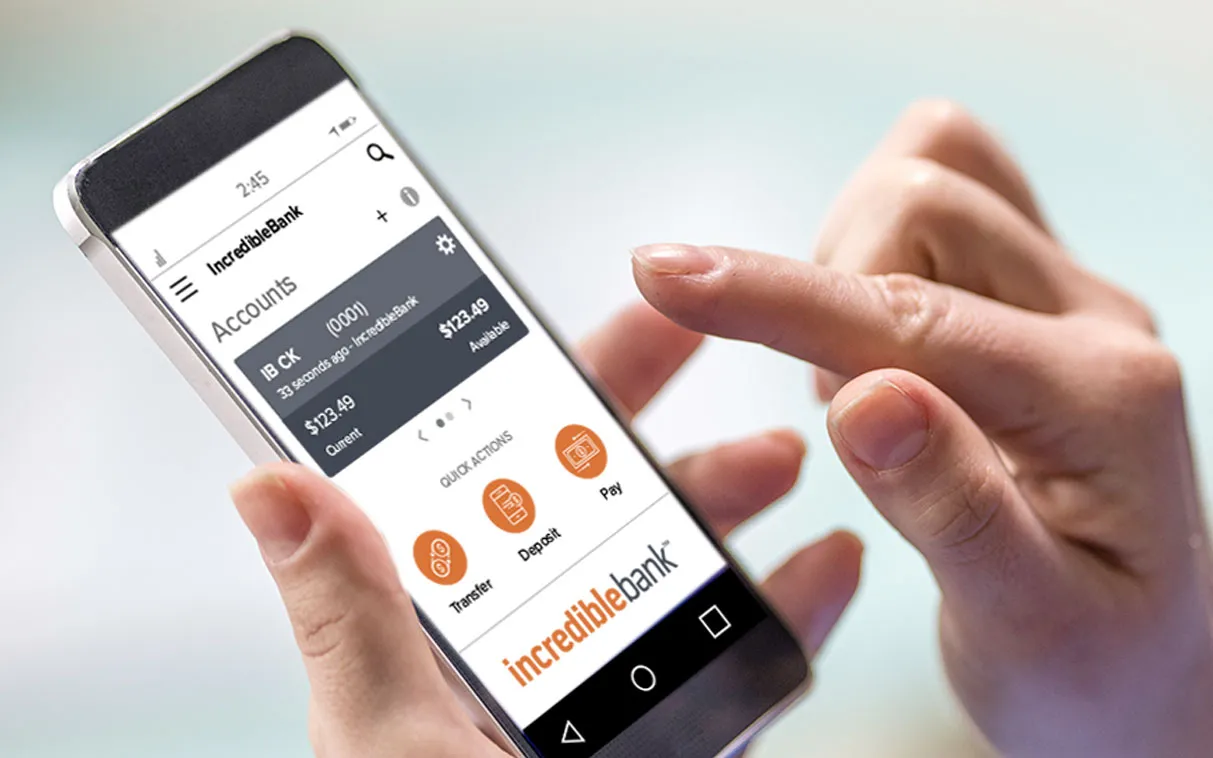

Mobile App

Stay in control of your finances from the palm of your hand. Pay bills anytime, deposit checks, check balances, view transactions, and transfer funds with our IncredibleBank mobile app.

Business Checking

You need a business checking account that gets the job done - so you can get your job done. We have multiple account options to meet your unique needs.