Which is better? Buying or renting?

The short answer is like that passive-aggressive relationship status on Facebook – it’s complicated.

The answer will be different for everyone depending on your unique circumstances, and there is no single right answer. In this article, we’ll highlight the major aspects of each aspect you’ll want to consider to determine what is right for you.

Cost

One of the first things you’ll want to consider when deciding whether to rent or buy is your budget. Is one option actually more cost-effective than the other?

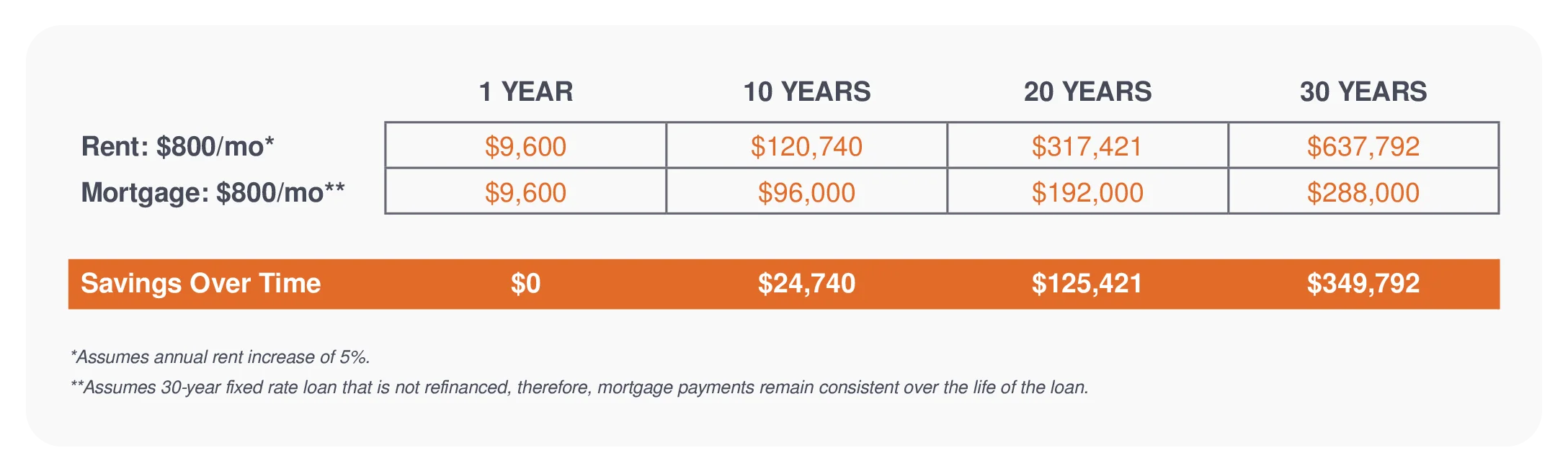

As with most big financial decisions, the answer isn’t one-size-fits-all. In many cases, a monthly mortgage payment can be similar to—or even lower than—rent for a comparable home, depending on current rates and local market conditions. Rent, on the other hand, often increases over time, while a fixed-rate mortgage can offer more predictability month to month.

The right choice ultimately depends on your personal finances, how long you plan to stay put, and what kind of flexibility you want. Talking through your options with a local lender can help you understand what makes the most sense for you.

In other words, not only will a mortgage payment sometimes be lower than a rent payment for a similar home, but your monthly payment will be much more predictable year over year than a rent payment. Curious about what your cost for renting vs. buying a home? Try our rent vs. buy calculator.

While all of that seems to be pointing heavy-handedly toward buying a home being the more cost-effective option, let’s pump the brakes a bit.

Along with homeownership come many other expenses beyond a mortgage payment. When the furnace blows in your rental unit, you call your landlord, and that expense is on them.

When you own your home, maintenance is your responsibility. Costs can add up, particularly with fixer-uppers—and even a renovation that looks great on TV usually comes with real-world costs.

There are other costs associated with homeownership as well, such as homeowners’ insurance, HOA (Homeowner’s Association) fees, trash pickup services, and others.

Finally, if you decide to buy rather than rent, you’ll have to have money set aside for a down payment and closing costs. But don’t let that deter you too quickly – there are programs available that allow for low and even no down-payments.

Generational Wealth

You’ve likely heard the term, but what is generational wealth? It refers to assets that are passed down from one generation to the next. It’s a way to leave something of value behind for your family. An example? Your home.

When you purchase a home, you can typically count on it increasing in value, and as you make regular payments, you will gain equity in your home. Equity is the difference between what your home is worth and what you still owe and represents the amount of your home you own outright.

Why is equity important? First, you can borrow against it if needed for other purchases or home renovations to continue to improve the value of your home at a rate lower than other types of loans and credit cards.

Additionally, if you do choose to sell your home, the equity can represent the profit you make from the sale, which can be invested or used for a down payment on your next home (and that down payment will create equity in your new home as well!).

It’s not fair to say that renting is throwing your money away, however. You have to pay for your living situation either way. However, when you pay rent, your payments are helping your landlord (not yourself) gain generational wealth and equity.

Freedom

On a scale from one to America, how free do you want to feel in your housing situation?

If you own your home, you will have freedom to renovate your home in ways you often can’t with a rental – put in new flooring, add on a patio, update the bathroom, plant a garden, take down that wallpaper (wait, scratch that, wallpaper is trendy again now) … put up new wallpaper, etc.

And let’s not forget your furry friends – while it can be challenging to find pet friendly rentals, when you own your home, there are usually not pet restrictions.

On the flip side, when you rent your home, you may have the freedom to move more frequently. Selling your home is a more complicated process than simply subletting your apartment or leaving at the end of a one-year lease.

On the other hand, if your landlord decides to sell the property or turn the apartment complex into condos, that may force your hand. Additionally, your landlord may ask you to renew your lease earlier than you are ready to commit – anywhere from three to even nine months before your lease ends. And if they find a renter for the unit before you decide? The choice is made for you.

Time Commitment

There are people out there who love yardwork. You know the ones – they mow the lawn in patterns that rival pro baseball stadiums, never seem to have any weeds, and spend just a few extra minutes after they’re done admiring their work.

Is that you? Cool – you will love owning your own home.

Not you? While you don’t have to spend hours manicuring your lawn, yardwork and home maintenance will still be a bit of a time commitment. Some HOAs may take care of some of this for you, but not all of it.

So if the thought of mowing the lawn once a week and spending some time working on home repairs or contacting plumbers sounds like more time and work than you’re willing to commit, you may be happier having a landlord take care of those things for you.

Tax Deductions

When you make your mortgage payments, your interest can be tax-deductible, whereas your rent payments are not.

However, the amount you pay in interest goes down over time, meaning the amount you can deduct does too. Additionally, while a nice benefit, the amount it saves you may not be a significant dollar amount.

Community Involvement & Stability

When you buy a home, you put down roots in a community. Your neighbors become friends. You feel part of something bigger.

While renting, you may find yourself needing to move every so often, moving your kids (and yourself) away from friends, and possibly even into different school districts. When you own your home, you help create consistency in your living situation, school district, and the community as a whole.

Phew! Well, I did warn you – it’s complicated.

There are a lot of things to consider, even some things not included in this list, and each one of them will have their advantages and drawbacks.

It’s a lot to consider, but keep in mind – there is no right or wrong answer. What’s right for your bestie may not be what’s best for you. And one option may be better for you today, and the other will be better a year from now.

Overall, it’s important to think about your own personal situation and make your decision based on what best suits your current needs and goals.