What Expenses Should I Plan for as a Homeowner?

You can expect some regular home maintenance costs – the costs that come up throughout the year like landscaping, home décor, appliance maintenance, plumbing, electrical, and more.

These costs can be hard to predict, but there are two methods you can use to get an idea of what to budget for: the 1% rule and the square foot rule.

In the 1% rule, you take the worth of your home and assume that your annual costs for home maintenance will be about 1% of that. For example, if your home is worth $100,000, you should budget for around $1,000 per year in home expenses.

With the square foot rule, you can expect to spend about a dollar for each square foot of livable space in your home. If your home has 1,500 square feet of livable space, you can expect to spend about $1,500 annually.

Not sure which to choose? Try budgeting for the higher number so you’re prepared – and if it costs less? Put it in savings!

What Should I Save For?

As a homeowner, you want to be prepared for several things. Earlier we talked about how to prepare for regular maintenance costs, but what about when the unexpected happens.

Keep in mind, that while there are regular expenses, you’ll also want to have money in savings for unplanned expenses. If your furnace dies or your roof needs replacing after a bad hailstorm, having money set aside will make these expenses more manageable.

You’ll also have to assume that over time, costs in general will go up – inflation will increase what you spend on groceries, clothes, and other items, and while the payments you make toward principal and interest on your mortgage will remain the same, your property tax rates are likely to increase from one year to the next.

So how much should you put into savings? Having six months of in savings is ideal, but that can be a challenging number to achieve. Shoot for a few thousand if you can to stay prepared for unexpected expenses.

And if you’re not there today, fret not. We’ve got a way to get you there with the 50-30-20 budgeting philosophy.

What is the 50-30-20 Budgeting Philosophy?

According to the 50-30-20 philosophy of budgeting, 50% of your budget should go toward essentials – things like your mortgage, cell phone bill, groceries, gas, and other bills.

Next, 30% of your budget should go toward your wants. Wants can include things like clothing, dining out, and entertainment.

The final 20% of your budget should go toward savings.

Here is a tool that will help you set your budget using the 50-30-20 method.

How to Set Your Budget

First, track all your regular monthly expenses, including your mortgage payment.

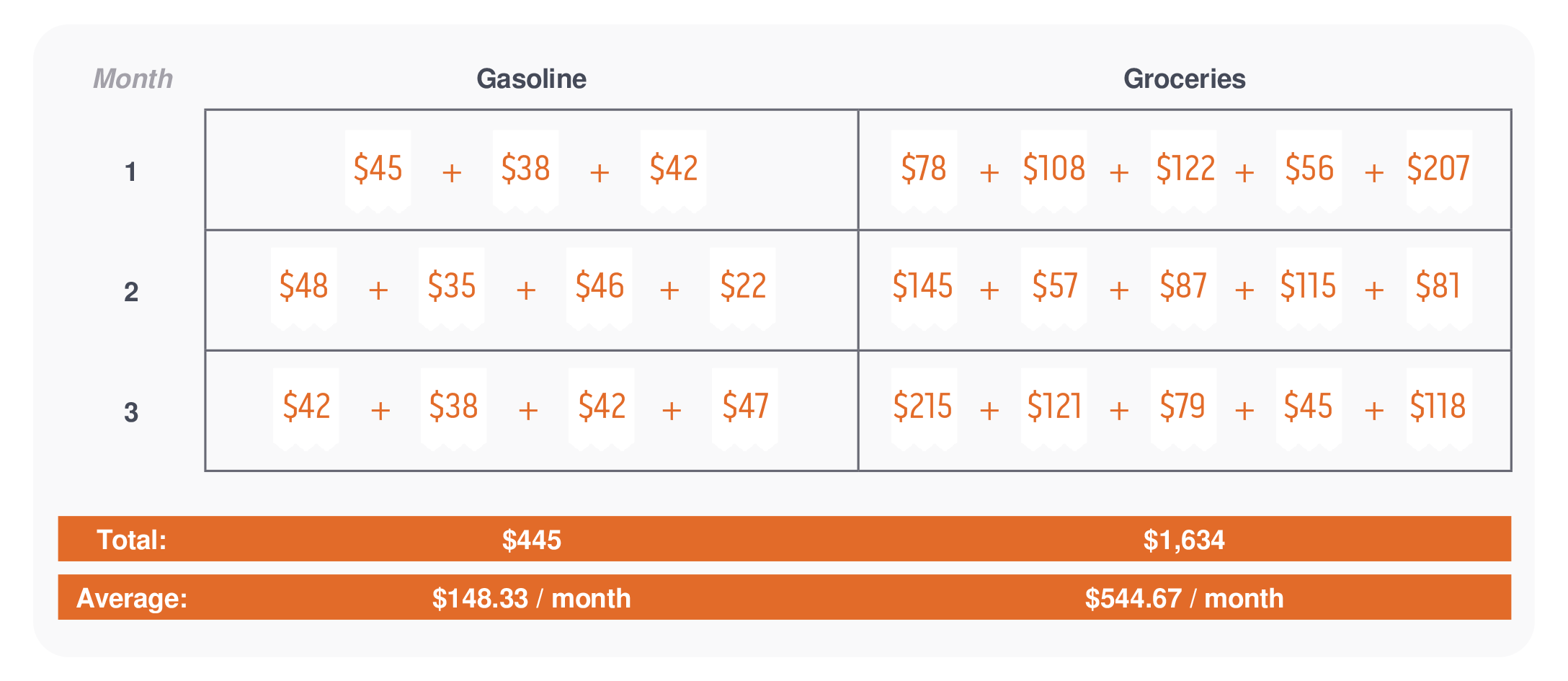

For fixed expenses, it’s pretty simple – track the monthly payment. For expenses that can vary from month to month, like gas or groceries, you’ll want to find an average.

For example, review your transactions from the past three months. Add up each transaction for each category to get a total. Then, add the total over a period of a few months – in the example below, we’re adding up three months. Finally, find the average by dividing the total dollar amount by the number of months.

You can use that dollar amount as your average. Note that if that time period had any unusual activity (for example, if you did a cross-country road trip or bought food for a big party), you may want to leave those expenses out of your usual expenses here.

Go through the same practice of finding your average expenses for your non-essential expenses as well. For example, look through your transactions for all of your clothes shopping, dining out, entertainment, etc. to find an average in each category.

Consider whether you need to adjust your spending in these areas in order to ensure you get your “wants” category down to 30% to leave more to go toward savings.

What if your necessities are above 50%? If that’s the case for you, you may need to cut down on your “wants,” but try not to cut out your wants entirely. Make sure you build in ways to have some fun, too, even if it means doing so on a budget.

You can also look for ways to lower the costs of your necessities, like eliminating your cable or removing some subscription or streaming services. If absolutely necessary, you can cut into your savings, but try to do that as a last resort.

Once you have your budget – stick to it. Each month, compare your spending to your budget, and continue to tweak your spending behavior as needed to ensure you are putting enough money aside for savings.

Hopefully with these budgeting tips, you can feel confident in your #adulting skills as a homeowner. Now give yourself a little break and leave unloading the dishwasher for later (or better yet, for someone else 😉).