Whether you're ready to buy a home with IncredibleMortgage, need a credit card, or are exploring personal loan options, we're is here to help. From mortgages to motorcoach financing, we offer flexible lending solutions tailored to your needs.

Let’s make it happen. Explore smart, supportive lending options built around you.

.jpg)

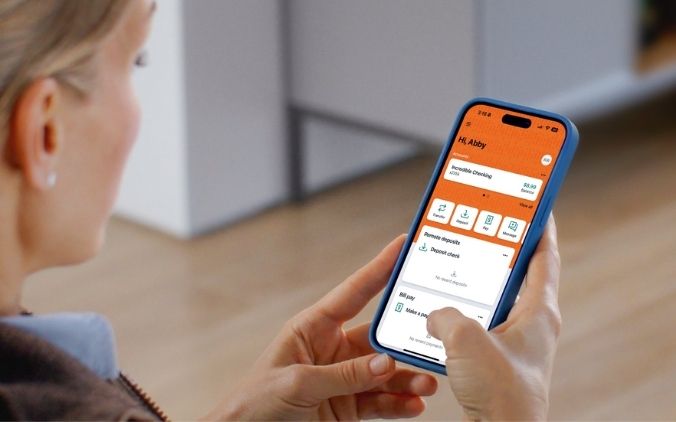

Finally—a banking app you can actually bank on and bank with. The IncredibleBank app gives you the freedom to manage your money anytime, anywhere. Deposit checks, pay bills, transfer funds, or even pay yourself—all from one secure, easy-to-use mobile wallet.

Ready to bank on the go? Learn more about the app and download it from the App Store or Google Play. For a deeper dive, check out the Mobile Banking User Guide

Achieve your financial goals with the expertise of IncredibleWealth, powered by Ameriprise Financial. Whether you’re planning for retirement, managing investments, or preparing for the unexpected, our dedicated financial advisors offer tailored solutions to help secure your future.

Ready to make confident financial decisions? Partner with IncredibleWealth to build a plan that’s designed for your needs.

A member of our team will contact you within one business day.