If you’re like most Americans, you either currently have or would consider holding accounts at multiple different banks.

And while there are benefits to having accounts in different places, it can make it hard to have a complete picture of your finances.

That’s why IncredibleBank is excited to offer financial account aggregation within our mobile and online banking platforms…and the best part is, this service is free!

“Account aggregation isn’t just a convenience, it’s a game-changer for how our customers manage their financial lives. By giving them a single, secure view of their entire financial picture, we’re helping them make smarter decisions, save time, and feel confident about their future.” says Phil Suckow, IncredibleBank VP Innovation.

Want to know how account aggregation can benefit you? Read on!

What is Account Aggregation?

Account aggregation refers to the collection of financial information from an individual or family’s accounts in one place. So, you can link your accounts from a different bank to your IncredibleBank mobile or online banking.

What Types of Accounts Can I Link with Account Aggregation?

If you have accounts at another bank, you can connect them so you can view them from within IncredibleBank mobile or online banking. Here are the types of accounts you can link:

Deposit accounts

View your deposit accounts like your checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs) that you hold at other banks or credit unions.

Loans

You’ll have access to your loans such as your auto loan, home loan/mortgage, home equity loan or line of credit, personal loans, and more, even if they aren’t at IncredibleBank.

Credit cards

See all of your credit cards in one place, including your rewards and travel credit cards you hold with other banks.

Investment accounts

You can even see investment accounts, such as your 401(k)!

Our account aggregation service allows you to connect to over 95% of financial institutions, including most banks, credit unions, credit cards, and investment companies. You can view your balances and transactions* for these accounts within your IncredibleBank mobile or online banking!

What Are the Benefits of Account Aggregation?

As you’re planning your financial future, it’s important to have a solid grasp of your current finances. That includes understanding all of your current cash on deposit and your total amount owed in loans. Account aggregation will allow you to do just that in one place!

“I love that our customers can better understand where they stand financially,” says April Scheurer, IncredibleBank’s Digital Experience Specialist.

With account aggregation, you don’t have to sign into every single account to see your financial picture. With just one login to your IncredibleBank mobile app or online banking, you can see all of the account balances and transactions in one secure place.

The process of connecting your accounts is simple and fast. Plus, you’re in complete control of which accounts are linked. So, if you ever change your mind, you can always remove accounts or add more.

Oh, and did we mention…this service is free!

How Do I Link My External Accounts?

First, make sure you have the online login information for all of the accounts you want to connect.

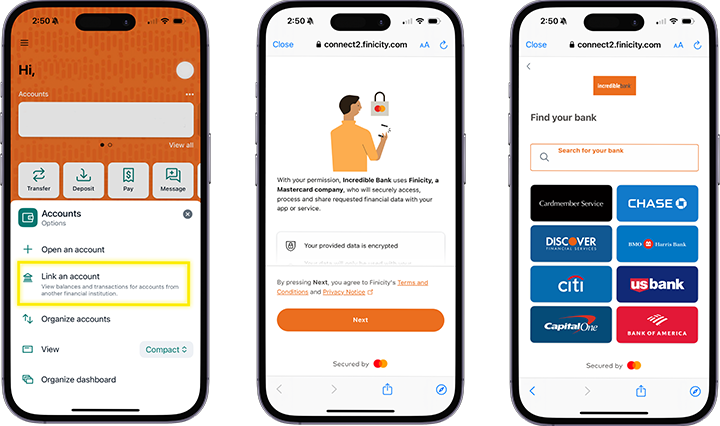

Then, log into mobile or online banking and click on the three dots next to Accounts. Select Link an Account and follow the prompts on the screen. You’ll need to enter your online username and password for the financial institutions you would like to link.

Continue to follow the prompts to get your account connected, then start over to add your next account!

How is My Data from My Aggregated Accounts Protected?

IncredibleBank protects the information shared through account aggregation in the same way we secure other information you share directly with us. We may use the information to better understand your entire financial picture and offer other products and services that match your needs and help you reach your financial goals.

Want to learn more about how we protect your privacy? See our Privacy Information.