Account Takeover Protection: What You Need to Know

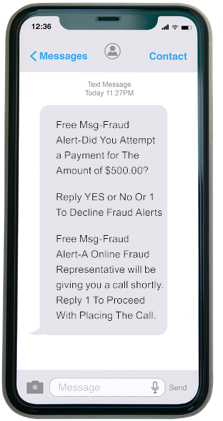

An account takeover begins with a fraudster sending a text message to your mobile phone. They usually claim they’re from IncredibleBank's fraud department. They may ask you to confirm a suspicious payment that was sent from your account — this may not be true and could be part of the fraud.

If this is a fraud attack, the fraudster may follow up with a phone call and asks for your personal information to “cancel the payment.” NOTE: IncredibleBank will NEVER ask for your full social security number, your online banking password, or other personal information.

Once the fraudster has access to your online banking credentials, they'll begin making changes to your account - updating your personal identifying information, adding an authorized user, or changing the password. These changes not only allow them access to your accounts, but also locks you out of your own account - hence the term "account takeover."

The account takeover fraud often begins on a Friday after business hours and runs through the weekend. It also often happens over the holidays. Why? Because they're hoping you take the weekend or holiday off and won't notice something's wrong till it's too late.

How to Protect Yourself: Quick Prevention Checklist

- Enable Two-Factor Authentication (2FA): Add an extra layer of security to your account.

- Monitor your account activity regularly: Check for suspicious transactions or login attempts.

- Be cautious with texts, emails, or phone calls: Fraudsters often impersonate your bank to steal information.

- Never share passwords or verification codes: Do not provide these over phone, text, or email.

- Use device protection and update software: Keep your devices secure and software up to date.

- Set up account alerts: Receive notifications for unusual activity to act quickly.

Steps to Stop Account Takeover Fraud Before It Happens

1. Be wary of texts, emails, or phone calls claiming to be your bank

2. Don't share your information

3. Don't rush

4. What to do if you've already provided your information

If you did mistakenly provide information to fraudsters, check your financial accounts for unusual activity, document it, and report it to your bank right away (in fact – report it to your bank even if you haven’t seen suspicious activity yet!). Your bank may also recommend additional steps to take to protect yourself.

If you provided your social security number, we recommend reaching out to the Social Security Administration and each of the three credit bureaus to place a credit freeze.

Learn more about protecting yourself from identity theft at our cybersecurity blog.

How Can You Prevent Account Takeover Fraud?

Don't Share Info

If someone posing as IncredibleBank contacts you by phone, email, or text message and wants you to share your personal information, consider it fraud.

Don't Reply

If you receive a text or email, don’t reply to the sender. Ignore the message and do not call any phone numbers listed in the text.

Hang Up & Call Us

If you receive a phone call that seems to be a phishing attempt, end the call immediately. Remember: local area codes can be misleading.

Frequently Asked Questions About Account Takeover Fraud

What is account takeover fraud?

Account takeover fraud occurs when a fraudster gains access to your bank account by stealing your login credentials or personal information. They may then change your passwords, lock you out, and initiate unauthorized transactions—often targeting your personal checking or savings accounts.

What are the signs of account takeover fraud?

Warning signs include unexpected texts or calls claiming to be from your bank, changes to your contact information, and unauthorized activity in your accounts. For businesses, unusual payroll or payment activity may also be a red flag. Tools like Positive Pay can help detect fraud early.

How does account takeover fraud usually happen?

It often starts with a phishing text message pretending to be from your bank. If you respond, the scammer may call you to gather more personal information and gain access to your account. For businesses, compromised credentials in payment or payroll platforms can also be a target—so be sure to use secure tools like IB Payroll.

What should I do if I suspect my account has been compromised?

Immediately contact IncredibleBank at 1-888-842-0221. Check your accounts for unusual activity, document what you see, and follow the steps your bank provides. If you're a business, consider enrolling in cash management tools to enhance your account security going forward.

How can I protect myself in the future?

Monitor your personal and business accounts regularly. Set up alerts, use strong passwords, and avoid clicking links in unsolicited messages. For business owners, tools like Positive Pay and secure payroll solutions can reduce risk and improve fraud detection.