Whether you’re buying a home or simply applying for a credit card, your credit score can make a major impact on the cost you’ll pay to acquire that product.

The higher your score, the lower your interest rate … and vice versa. And, of course, if your score is too low, you may not qualify for credit products at all.

So, if you currently have a bad credit score, how can you repair your credit?

Here is how to first determine the accuracy of your credit report and score, and how to improve your credit score if you need to.

This blog will help you answer these questions:

- How my credit score impacts my loan

- How to check my credit report for accuracy

- How to remove collections from my credit report

- What to do if I lose my job

- What to do with medical debts

How my credit score impacts my loan

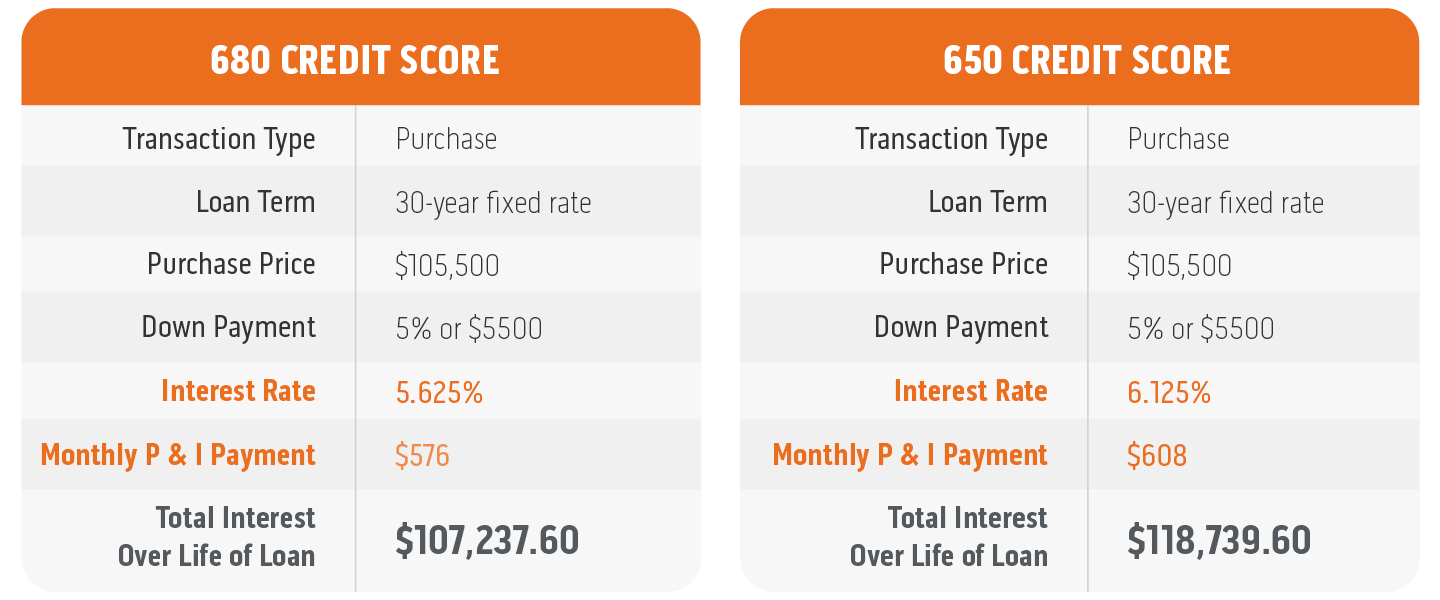

As mentioned earlier, the higher your score, the lower your interest rate, and vice versa. Here’s an example of how your credit score can impact how much you pay in interest over the life of your loan.

Note: Rates listed in the scenarios above are for illustrative purposes only. Payment examples are rounded to the nearest whole dollar. Payment examples do not include amounts for taxes or insurance premiums. If applicable, the actual payment obligation will be greater. Actual Annual Percentage Rates (APR) and interest rates may vary based on the terms of the loan selected, underwriting, credit history, down payment, and debt-to-income ratio. All loans are subject to underwriting and credit approval. Rates are subject to change without notice.

As you can see in the example, even with a 30-point increase in credit score, there are potentially significant savings in interest over the life of the loan.

How to check my credit report for accuracy

Get your free credit reports

Start by heading to annualcreditreport.com and getting a copy of your credit report.

You can get a free credit report (one from each of the three credit bureaus – Equifax, TransUnion, and Experian) every year, for a total of three. You can either get all three at once, or you can spread them out over the course of the year.

If you plan on making a big purchase (such as a home) in the near future, you may want to get all the reports at once so you can review each. Depending on the timing of when each of them pull the report, the information can vary slightly.

If you have no major purchases on the immediate horizon, we recommend spreading them out over the course of the year. This will allow you to see so you can see any changes over time and catch anything that might be inaccurate or damaging sooner rather than later.

Review your credit report

- All credit products associated with your social security number, including:

- Revolving accounts (such as credit cards and lines of credit)

- Mortgages

- Installment loans (such as auto loans)

- Inquiries that happen when you request a credit product, and the lender pulls your credit score

- Public records (such as bankruptcies)

- Collections (unpaid loans that have been reported)

Your report will not include the actual score associated with your report. You may request your score from the bureaus, but they will charge a fee.

Dispute credit report inaccuracies

You’ll want to review all of these accounts closely to ensure they are all correct and truly belong to you. If you do find any inaccuracies on your report, you can dispute the charges with each bureau, and they will investigate on your behalf.

How to remove collections from my credit report

If you have ever had a loan that you were unable to repay, your lender may have reported the account as a collection. That means they likely sold it to a collection agency, who purchased the debt at a discount.

For example, if you owed $5,000, the collections agency may have purchased your debt from your lender for, say, $2,000. This way, your lender is able to recover at least some of the losses, and they transfer the debt to the agency.

Even if you pay this collection off, it will remain on your report as a collection, but it will be marked as a paid collection.

So, what can you do to remove collections from your credit report?

Request a goodwill deletion

If you have already paid off this collection, one option available to you is to request a goodwill deletion of the collection. You can do this by mailing a goodwill letter to the collection agency explaining your situation and asking that they remove the collection.

Dispute inaccurate collections

If the collection is an error, you can dispute the collection on each credit bureau’s website.

Negotiate with the collection agency

If you have not paid the collection yet, you can negotiate with the collection agency for a pay-for-delete. In other words, you ask that if you pay off the debt to them, they will delete it. As mentioned earlier, they typically buy your debt at a discount, so if you pay it back in full, they profit, and therefore may be willing to help you.

Wait it out

If the collection is accurate and the collection agency will not remove it for you, your final option is to simply wait for the collection to fall off your account. That collection can remain on your account for up to seven years.

What to do if I lose my job

There is a lot of stress around losing your job, particularly around your finances. If you lose your job and want to avoid your credit score taking a major hit, here are a few things you can do.

Request a mortgage forbearance

Contact the lender for your home loan and request that they pause your payments without marking you as delinquent.

If they are willing to do this, you may be able to go a period of time without making mortgage payments (known as deferred payments) without your credit taking a major blow.

However, there is a downside to this option. Interest will continue to accrue during this forbearance period, so in the long run, it will add to the cost of your loan and the time it takes to pay it off.

That said, it’s a far better option than late payments, or worse yet, a foreclosure on your record.

Is your mortgage with IncredibleBank? Contact us at accountservices@incrediblebank.com to learn your options if you’re facing a hardship.

Ask your credit card issuers for payment flexibility

If you have credit cards that carry balances month to month, contact your issuers to see if they can be flexible with your payment terms without marking your payments as late.

Ask other lenders for flexibility

Do the same with your other loans, such as auto loans and personal loans.

What do I do if I have medical debts?

Medical debts can be the most frustrating to manage, simply because they are often not our fault, and you can’t always plan for them. If you have medical bills piling up, here are a few steps you can take.

Know the changes to medical debt reporting

The good news is that credit bureaus recognize that these are a different type of debt and handle them slightly different.

Medical bills typically are only reported once the debts are sold to a medical debt collection agency, so they usually aren’t reported as late payments by the providers. Then, once they are reported to the agency, there is often a delay in putting it on your credit report for up to six months.

Dispute any inaccuracies

If you do have unpaid medical debt on your credit report, be sure to check it for accuracy as with all other aspects of your credit report, and place a dispute if you notice anything incorrect.

Know your insurance policy

Review your insurance policy, and work with your insurance provider to ensure they pay the bills they agreed to cover.

Request a payment plan

Negotiate with your medical provider to see if they are willing to work with you to develop a payment plan or to reduce your cost.

Crowdfund your medical bill

You may not love the idea of asking for help, but your loved ones may be more than willing to help with medical bills. Consider using a crowdfunding website, and send it to friends and family who may be able to contribute even small amounts to your care.

Whether your credit is good, bad or somewhere in between, it’s important to know your rights and your options.