Know Your Budget

Seems obvious, right? Maybe so, but it can be more complicated than you’d think to make sure you’re sticking to homes in your budget.

Because what you can technically afford from your lender’s standpoint may be more than you’ll feel comfortable with for your monthly mortgage payment.

To be sure you stay within your own budget, you’ll want to start by tracking all your monthly expenses. Then, track all your monthly income that you can generally count on every month – like payroll from your job. Use our free budgeting tool to help you track your expenses and income.

When you consider your payroll, be sure to track based on your actual take-home pay (or net income) rather than your regular salary before taxes and benefits (or gross income). While your mortgage application will ask for your gross income, you’ll want to consider your net income when deciding how much home you can afford.

Once you set your budget – don’t get tempted to look at houses outside your budget. You’ll either have higher expectations of a home than what you can reasonably afford, or you’ll end up with a payment that’s more than you’re comfortable with.

Finally, bear in mind that taxes, insurance, Homeowner’s Association fees, and other fees are often included as a part of your monthly payment above and beyond the principal and interest for the loan.

Save Money

You’ll need some money for a down payment and closing costs (more on that soon).

You’ll also want to have a bit of money in savings to help pay for any unexpected costs associated with homeownership. You can also ask the seller for a home warranty. This warranty can help cover the cost of any unexpected problems after moving in, such as replacing or fixing broken appliances, furnace repairs, and more.

As soon as you’re able, begin setting aside money. Consider setting up an automatic payment from your checking to go into savings or having a portion of your direct deposit go straight into savings.

Learn More about Down Payments

First, it’s important to know that there are plenty of programs available to help you with your down payments – check them out here.

But in addition to the down payment assistance programs listed in the link above, did you know you can also be gifted money for a down payment? It must be from an approved gift-giver (such as a family member, employer, domestic partner, fiancé, etc.) and must be a true gift and not a loan, but this option can help you gather the money you need for your down payment.

You can also consider taking a 401(k) loan. Typically, loans aren’t allowed to be a part of your down payment, but with a 401(k) loan, you’re essentially borrowing from yourself, so your lender will allow it. Just be sure that it’s approved through your 401(k) summary plan description!

Finally, consider using your next tax refund. It’s a great way to come up with funds for your down payment.

Monitor Your Credit

Make sure you’re keeping a close eye on your credit as you prepare to buy a home – especially any debts that could potentially end up as garnishments.

Additionally, you’ll want to ensure you stay current on your existing debts as best you can to avoid issues.

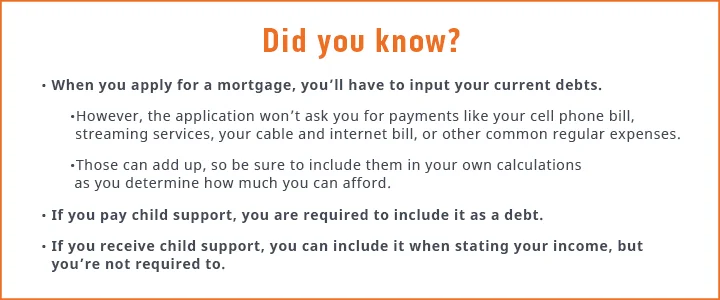

If you’re able to, pay down any debts like credit cards. Your lender is going to use a ratio called debt-to-income ratio (or DTI) to determine whether they can make a loan to you. If you have a higher DTI than the lender allows, you may not be approved for the loan, or it may impact the rates and terms of your loan.

And of course, check to make sure your credit report is accurate. You can get a free credit report up to three times per year at annualcreditreport.com. Keep an eye out for any new credit accounts you don’t recognize.

Take Advantage of Homebuyer Education Programs

Finally, look for homebuyer education programs. These programs can help teach you about:

- The process of applying for your loan

- Personal finance skills such as budgeting and credit

- How to plan for maintenance and other costs

- The benefits and drawbacks of owning your own home

Some loan programs may require a homebuyer education course, but even if it’s not required or if you’ve already owned a home, there is a lot to be gained from taking these courses.

As you consider buying a home, be sure to prepare by taking the steps above to ensure you’re financially prepared.