“Fraudsters don’t need to hack your computer — they just need to trick you.”

When it comes to cyber fraud, there are plenty of digital ways to protect ourselves, from firewalls to anti-virus.

But the most common types of banking fraud aren’t always perpetuated by skilled computer hackers, but rather by master manipulators. And while the goal is to steal funds from your accounts via online or mobile banking, the target isn’t your computer.

It’s you.

Common Types of Banking Fraud›

What Happens Next›

How Fraudsters Contact You›

FAQ›

Common Types of Bank Fraud

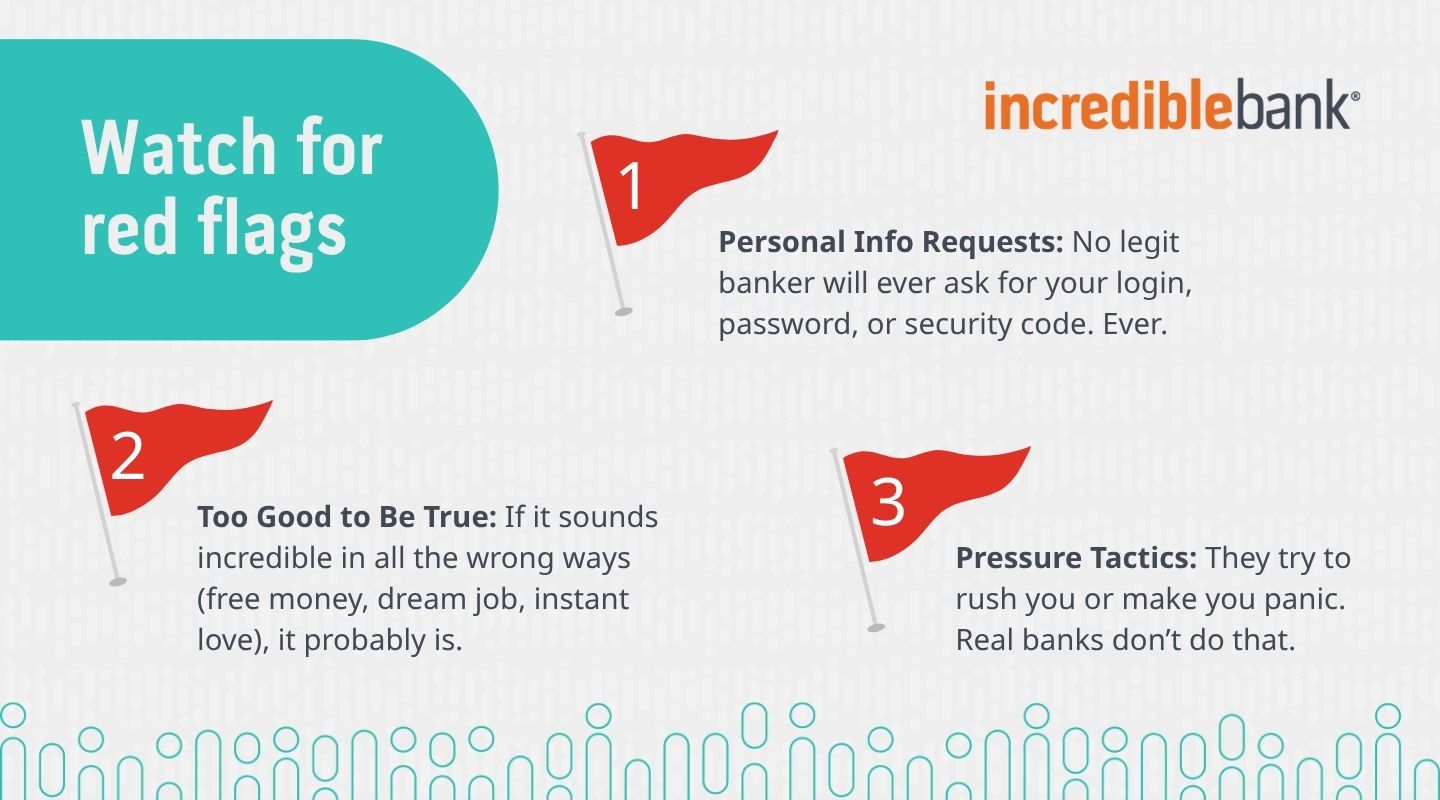

Here are some of the most common stories these manipulators will use to gain access to your bank accounts. Watch for the red flags!

The Bank Investigator

🚩 They claim they're investigating an employee of the bank for stealing, embezzling, or another financial crime. They ask you to complete a transaction, such as sending a Zelle® payment, or perhaps a wire transfer, and say it will help them catch the criminal in the act.

🚩 They ask that when you complete this transaction, you don't tell the banker you're working with about the investigation.

The Job Offer

🚩 You’re on the hunt for a great new job. You applied online and get a job offer. As part of onboarding, your employer directs you to open an account with a specific bank (perhaps IncredibleBank or another financial institution) because that’s where you’ll receive your direct deposit.

🚩 Instead of asking for the routing number and account number, they ask for your login credentials.

The Online Friend

🚩 You meet someone online, and over the course of nearly a year, you have developed a great friendship. They offer to help you pay for college expenses. They ask you to open your account with a specific bank so they can deposit money. Even when you explain you already have an account somewhere else, they insist you open a new account and give reasons why it’s better this way.

🚩 You provide your online banking credentials so they can deposit money.

The Banker Call

🚩 You get a phone call, and the caller ID says it’s from your bank. The caller tells you he works for the bank and needs you to provide your online account credentials, claiming there are potentially fraudulent transactions.

🚩 He stays on the line, tells you you may get a code via text, and asks you to provide it—even though the text says not to share it.

The Sweetheart Swindle

🚩 You start dating someone online. Every time you try to meet in person, they have valid reasons they can’t, including last-minute cancellations. To make it up to you, they offer to pay for your flight. They ask you to open an account with a specific bank and ask for your online banking credentials to deposit funds.

🚩 You provide your online banking credentials.

Remember: never give anyone your online banking credentials — no matter how convincing their story may seem.

What Happens Next?

Next, the scammer logs into your account and sends themselves money using Zelle® or bill pay. They may also link external accounts and send in bogus deposits, withdrawing the money before the deposit can be returned.

The worst part? You would be on the hook for overdrawn account fees, because providing online banking credentials to someone else is considered giving them authorization to do transactions. You may not be covered under consumer protection regulations.

These are just examples. Fraudsters use a multitude of stories and techniques to get your online banking credentials.

Knowing what to watch for is the first step to protecting your finances. Here are three red flags every customer should recognize. (Image credit: IncredibleBank)

How Do Fraudsters Contact Me?

- Pop-up window on your computer

- Phone call

- Text

- Social media

- Dating sites

- Online job sites

This list is far from comprehensive. Fraudsters will use any method to reach their next potential victim. Be on the lookout for red flags.

None of the stories above required special computer skills — only enough acting to convince you to give up your online banking credentials.

Staying alert and protecting your credentials is the simplest way to outsmart fraudsters and keep your money safe.Want to protect your accounts even further? Discover our fraud prevention tools and tips to keep your finances secure.

Want to protect your accounts even further? Discover our fraud prevention tools and tips to keep your finances secure.